First-Time Car Financing: Complete Guide to Getting Your Best Deal

Understand car financing basics

Car financing allow you to purchase a vehicle by borrow money and pay it backrest over time with interest. When you finance a car, you’re basically take out a loan where the vehicle serve as collateral. This mean the lender can repossess the car if you fail to make payments.

Two primary financing options exist: dealership financing and direct lending from banks or credit unions. Dealership financing offer convenience since you can shop and finance in one location. Direct lending involve secure a loan from a financial institution before visit the dealership, give you more negotiating power.

Prepare your finances

Before step into any dealership, assess your financial situation good. Calculate your monthly income, exist expenses, and determine how practically you can realistically afford for a car payment. Financial experts recommend keep your total monthly vehicle expenses under 20 % of your take home pay.

Check your credit score use free services like credit karma or annualcreditreport.com. Your credit score importantly impact your interest rate and loan terms. Scores above 700 typically qualify for the best rates, while scores below 600 may require higher interest rates or co-signers.

Gather necessary documents include recent pay stubs, tax returns, bank statements, and proof of residence. Have these ready streamline the application process and demonstrate financial responsibility to lenders.

Set your budget

Determine your budget by consider the total cost of ownership, not fair the monthly payment. Factor in insurance, maintenance, fuel, registration fees, and potential repairs. A reliable budgeting approach involve the 20/4/10 rule: put down at least 20 %, finance for no more than 4 years, and keep total monthly vehicle expenses under 10 % of gross income.

Consider both new and use vehicles within your budget. New cars offer warranties and latest features but depreciate quickly. Use cars provide better value but may require more maintenance. Certified pre own vehicles offer a middle ground with limited warranties and thorough inspections.

Source: pubard.com

Shop for the best rates

Start by get pre-approve for financing from multiple lenders. Banks, credit unions, and online lenders oftentimes offer competitive rates. Credit unions often provide the best rates for members, sometimes 1 2 % lower than banks.

Compare annual percentage rates (aApr)sooner than fair interest rates, as apAprnclude additional fees. A lower apAprave money over the loan term. For example, on a $ $2000 loan, a 1 % difference in aprAprn save over $ 1$10 during a 5 ye5-yearm.

Online lenders like Capital One auto finance, light stream, andpennedd offer competitive rates and quick approval processes. Many provide rate quotes without affect your credit score through soft inquiries.

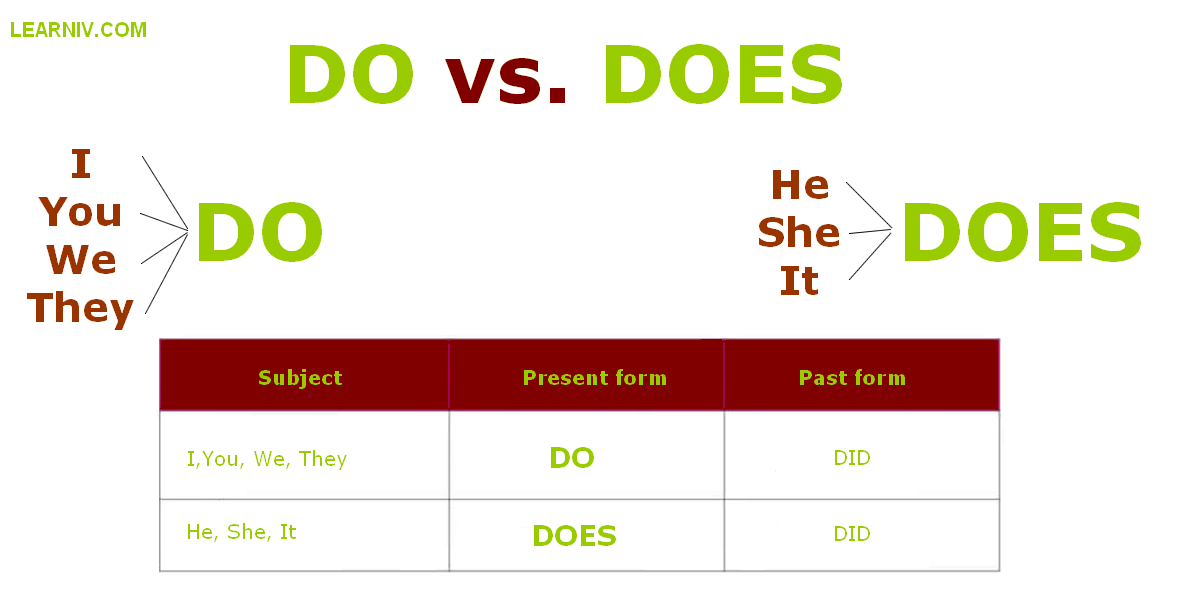

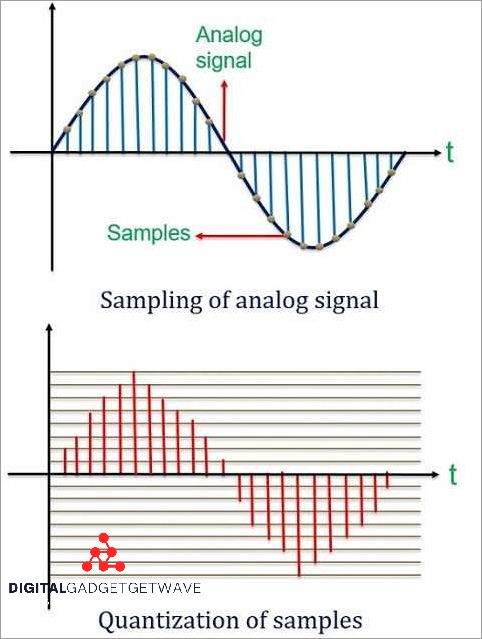

Understanding loan terms

Loan terms typically range from 36 to 84 months. Shorter terms mean higher monthly payments but less interest pay boiler suit. Longer terms reduce monthly payments but increase total interest costs importantly.

Consider this example: a $25,000 loan at 5 % aAprcost $$471monthly for 60 months with $ $360 in total interest. The same loan for 72 months cost $ 4$402nthly but $ 3,$3 in total interest – almost $ 700$700.

Will avoid exceedingly long loan terms will exceed 72 months, as you’ll probable will owe more than the car’s worth for most of the loan period. This situation, call being” top downwards ” r “” derwater, ” ” create problems if you need to sell or trade the vehicle other.

Down payment strategies

A substantial down payment reduces your loan amount, monthly payments, and total interest pay. Aim for at least 20 % low on new cars and 10 % on use vehicles. Larger down payments likewise help you avoid being underwater on the loan directly.

If you’ll lack sufficient cash, will consider trading in your current vehicle, though you’ll typically get less than sell privately. Some manufacturers offer low or zero down payment promotions, but these normally require excellent credit and result in higher monthly payments.

Save for a down payment by set aside money monthly in a dedicated savings account. Yet an extra $1,000 down can save hundreds in interest over the loan term.

Navigate dealership financing

Dealerships work with multiple lenders and may offer promotional rates from manufacturers. Yet, they besides mark up interest rates to increase profits. Having pre-approve financing give you leverage to negotiate better terms.

Don’t focus exclusively on monthly payments during negotiations. Dealers may extend loan terms to lower payments while increase total costs. Alternatively, negotiate the vehicle’s price 1st, so discuss financing terms individually.

Source: geeksforgeeks.org

Watch for add-ons like extended warranties, gap insurance, or paint protection that dealers may include without clear disclosure. While some add-ons provide value, many are overpriced or unnecessary for first time buyers.

Alternative financing options

Consider certify pre own (cCPO)programs that combine use car savings with manufacturer warranties and financing incentives. These programs much offer lower interest rates than traditional use car loans.

Lease to own or rent to own programs exist but typically cost importantly more than traditional financing. These options may suit buyers with really poor credit but should be last resorts due to high costs.

Family financing, where relatives provide loans, can offer flexible terms and lower rates. Nonetheless, mix family and finances can strain relationships if payments become difficult.

Building credit for better rates

If your credit need improvement, consider wait to purchase while build your score. Pay down exist debts, make all payments on time, and avoid open new credit accounts before apply for car loans.

Consider have a co-signer with good credit to qualify for better rates. Nonetheless, remember that co-signers are as responsible for the debt, and miss payments affect both parties’ credit scores.

Some lenders specialize in financing for buyers with limited or poor credit history. While rates may be higher, successfully complete these loans help establish positive credit history.

Avoid common mistakes

Don’t shop for cars before understand your budget and financing options. Fall in love with an unaffordable vehicle lead to poor financial decisions and potential buyer’s remorse.

Avoid focus solely on monthly payments kinda than total costs. A lower payment stretch over many years much cost more overall than a higher payment for a shorter term.

Don’t accept the first financing offer without shop about. Yet with good credit, rates can vary importantly between lenders. Invariably compare multiple offers before commit.

Resist pressure to purchase expensive add-ons or extended warranties on the spot. Take time to research these products and their actual value before decide.

Finalize your purchase

Read all documents cautiously before sign. Ensure the interest rate, loan term, and monthly payment match what you agree upon. Don’t hesitate to ask questions about anything unclear.

Verify that the vehicle identification number (vVIN)on the loan documents match the car you’re purchase. This prpreventsotential legal issues late.

Understand your payment schedule and method. Many lenders offer slight interest rate reductions for automatic payments from your bank account.

Keep all finance documents in a safe place and make note of your first payment due date. Miss your first payment can damage your credit score and relationship with the lender.

Manage your car loan

Set up automatic payments to ensure you ne’er miss a due date. Late payments result in fees and credit score damage. If possible, pay somewhat more than the minimum to reduce interest costs and pay off the loan quick.

Consider make extra payments toward the principal balance when your budget allows.Fiftyy an extra $ 50 $50hly can save hundreds in interest and shorten the loan term importantly.

Maintain comprehensive insurance coverage throughout the loan term, as lenders require this protection. Shop for insurance rates yearly, as better deals may become available.

If financial hardship occur, contact your lender directly to discuss options. Many lenders offer temporary payment deferrals or loan modifications kinda than proceed with repossession.

Successfully manage your first car loan build positive credit history and positions you for better rates on future vehicle purchases. This foundation of responsible borrowing benefits your overall financial health for years to come.

MORE FROM promospotlight.com